ISAs and cash ISAs with other banks. Open this account with between 1 and 1000 then put away between 1 and 200 a month with this option.

|

| Check Out This Behance Project Natwest Rbs Isas Animated Guides Https Www Behance Net Gallery 51888171 Natwest Rbs Animation Make It Simple Simple |

Go to our transfer form.

. You can transfer money from an ISA you have with us or another bank. Ad Move your savings to Capital One. This means that your money up to 20000 in the current tax year is safe from tax. Find out how to transfer an ISA.

Bank of Scotland Cash ISA Reviews. The ISA allowance is 20000 this tax year. 2 Fixed Cash ISA. Lower rates than the fixed-term ISA.

Share Dealing Self-Select ISAs. Manage your ISAs online in a branch or over the phone. You can choose to have easy access to your money and withdraw free of charge the rate you receive on this account will be variable. Oh and if you have experience using a Bank of Scotland ISA you can write a review too.

Like all Cash ISAs Bank of Scotland cash ISAs allow you to maximise your savings by not paying tax on the interest you earn. If youre an existing customer looking to make changes to your Bank of Scotland cash ISA we have two options that may interest you. Open the Access ISA with as little as 1. How to transfer to a Bank of Scotland cash ISA.

This includes Help to Buy. No monthly fees to hold you back. The personal savings allowance which gives you 1000 tax-free depending on your tax band. Last review 1 year ago.

What type of Cash ISA does Bank of Scotland offer. This means you will usually get a higher fixed interest rate. Bank of Scotland ISA reviews from our Smart Money People can help you to give you the inside track on what having an ISA with Bank of Scotland is really like. Prices up 124 in year to April 2022.

If you have a Bank of Scotland mortgage find out more here. Unlimited free withdrawals. Average UK property worth 281161. If you want to reach the full ISA limit in a tax year youll have to invest any other new contributions into other permitted.

1 Access Cash ISA. Interest rate can vary. This includes Help to Buy. Get a government bonus with the Help to Buy ISA.

ISAs are a good and flexible way to help you make more of your money. Open an account in 5 minutes and see the difference. The ISA allowance is 20000 this tax year. This means you can save up to 20000 in total across your ISAs this tax.

Find out how to transfer an ISA. The ISA allowance is 20000 this tax year. You can transfer an existing cash or stocks shares ISA to a cash ISA at Royal Bank of Scotland. Account become ISA Saver after one year.

ISA allowance is lower than the overall 20000 ISA allowance as you can only pay in up to 200 in any calendar month. Unlimited and easy withdrawals. If you do not already have one view our range of cash ISAs. The Bank of Scotland Cash ISAs are just like saving accounts which pay interest.

Accessibility statement Accesskey 0 Go to Accessibility statement. You can choose to save in a variety of ISAs as long as you dont exceed the annual 20000 allowance. The Bank of Scotland currently has several cash ISAs available. ONS Reports 124 Rise In Property Prices.

Ratings based on 11 reviews. 040 tax freeAER fixed for the 2 year term. You can transfer it to a new or existing cash ISA with us. Like all Cash ISAs RBS Cash ISAs allow you to maximise your savings by not paying tax on the interest you earn.

Fixed Cash ISA With this ISA you can deposit a lump sum and watch your savings grow tax free. An ISA Individual Savings Account is a tax-efficient way to save or invest. Your eligible deposits with Royal Bank of Scotland are also protected up to a total of 85000 as per the Financial Services Compensation Scheme. Open a cash ISA unless you already have one.

You can also transfer to an Bank of Scotland cash ISA from another provider if your current provider offers lower interest rates. Get fixed rates with the Help to Buy and 2 year Fixed ISA. 3 Junior Cash ISA. You can transfer an ISA you have with us or another bank.

Renewing your account means either changing the type of account you hold or changing the rate of interest that your account pays. Royal Bank of Scotland currently has several Cash ISAs available. Cash ISAs will usually pay a fixed rate of interest or a variable rate. In our Royal Bank of Scotland Instant Acess ISA your money is not invested.

If you are coming to the end of your mortgage credit card or loan payment holiday we will contact you before it ends there is no need to call us. Minimum deposit of 500. You can only save into one cash ISA in a tax year unless you do an ISA transfer. This means you can save up to 20000 in total across your ISAs.

Then save what you like as long as you dont go over your ISA allowance. You can also decide to lock your money away in a fixed Cash ISA. Instant Access Cash ISA. If you currently have a cash ISA with another provider.

This account gives you a fixed rate of interest. FDIC-insured savings with Capital One. This must be paid by standing order and received by the 25th of the month this can include the month you transfer your ISA. You can also transfer to an RBS Cash ISA from another provider if your current provider offers lower interest rates.

Visit the Bank of Scotland website to find out more. You will need to open a Bank of Scotland cash ISA to transfer your funds into. You need to open the account with at least 1. The Help to Buy.

Bank of Scotland offers a variety of Cash ISAs. If your cash ISA changes to an ISA Saver it counts as the same cash ISA because the sort code and account number will stay the same. What is a Bank of Scotland Cash ISA. Withdrawals are usually permitted at any time from a Stocks and Shares ISA.

Our simple transfer process safeguards your tax-free entitlement. The interest they pay is tax-free and outside of your personal allowance. A cash ISA is a savings account where you do not pay tax on interest you may earn. Transfer your cash ISA to us.

Bank of Scotland cash ISAs. The Help to Buy government backed ISA A Fixed Cash ISA and an Access Cash ISA. ISAs and cash ISAs with other banks. If you already have a cash ISA with us you can skip straight to step 2 below.

Choose to have interest paid after each year or each month. Learn everything you need to know about ISAs with our guide and answers to key questions. How long the account stays open. Bank of Scotland ISA Promise.

Bank of Scotland currently offer a range of ISAs including. The total amount you can save in ISAs in the current tax year is 20000. Bank of Scotland have two Cash ISA products on offer a variable-rate Cash ISA and a fixed-rate Cash ISA.

|

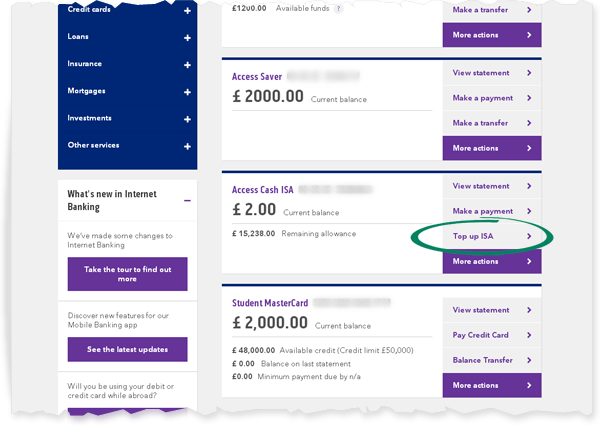

| Bank Of Scotland Isas Top Up Your Isa |

|

| Isas Back In Fashion As 13 Million People Open A New Account Money The Times |

|

| Billetes Billetes Del Mundo Monedas |

|

| Cash Isas The Facts |

|

| Pin On Currency Stamps Tickets |